Protect Your Family's Financial Future

- Return Of Premium Option5a

- Spouse Cover Offered

- Premium Waiver Benefit

- 0% GST

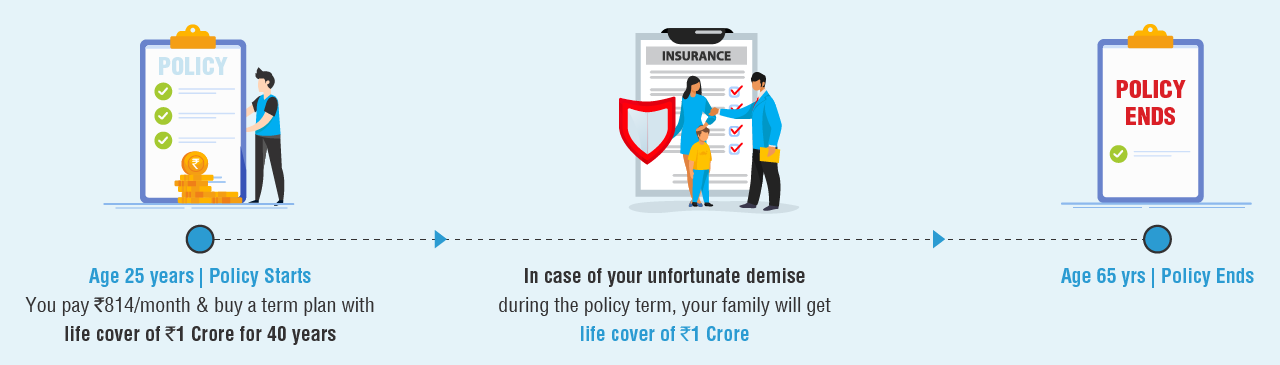

₹1 Crore Life Cover at ₹626/month

Enter OTP

An OTP has been sent to your mobile number

Application Status

Name

Date of Birth

Plan Name

Status

Unclaimed Amount of the Policyholder as on

Name of the policy holder

Policy Holder NamePolicy No.

Policy NumberAddress of the Policyholder as per records

AddressUnclaimed Amount

Unclaimed AmountRequest Registered

Thank You for submitting the response, will get back with you.

Request Registered

Thank You for submitting the response, will get back with you.

Thank you for sharing your details. Our financial advisor will connect with you shortly to assist with your financial planning. You will now be redirected to the next step in case you would like to continue on your own..

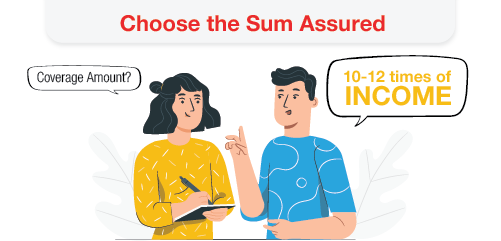

A Detailed Look at How the Plan Works

About Young Term Plan

Canara HSBC Life Insurance Young Term Plan is a flexible life insurance policy designed to cater to individual needs. It is a non-linked, non-participating, individual, pure-risk premium plan that provides two plan options based on your financial needs i.e. Life Secure and Life Secure with Return of Premium.

You can think of it as a shield, protecting them from life's uncertainties. If something unexpected happens to you, the plan will provide your loved ones with a lump sum amount so that they can at least fight the financial storm and keep their life and dreams on track. You can relax knowing your loved ones will be cared for, no matter what.

Canara HSBC Life Insurance

We have over 15 years of experience in delivering exceptional value to our customers through our range of individual and group insurance solutions, designed to meet their various needs, including savings and investment, retirement, protection, and more.

15,700+ Partner Branches

15,700+ Partner Branches

Canara Bank, HSBC India, Other Alternate Channels

₹44,089 Cr Assets Managed

₹44,089 Cr Assets Managed

Assets Managed as of Sep' 25

99.43% Claims Settled

99.43% Claims Settled

Individual Death Claims settled for FY 2024 - 2025

197.8% Solvency Ratio

197.8% Solvency Ratio

Way Above the IRDAI Mandate

Frequently Asked Questions

There is mainly only one eligibility criteria: You must be at least 18 years old to buy a Young Term Plan.

You can buy the Young Term Plan online on our website. You can go through various options such as 1 crore life insurance plan, 2 crore life insurance plan and family term insurance along with other online term insurance plan options on the website. You can also get access to an online term insurance premium calculator on our official website.

One of the benefits of the Canara HSBC Life Insurance Young Term Plan is the Block Your Premium option. Life Assured/Working Spouse, as applicable, has the option to block their premium rate of base Death Benefit at policy inception for a period of 5 Years. In this duration, Life Assured/Working Spouse, as applicable, can request for an increase in benefit amount payable on death (BYP Sum Assured) up to 25%/50%/75%/100% of the Sum Assured as chosen at policy inception for respective live(s) without any additional underwriting and irrespective of the attained age, subject to applicable conditions mentioned under the Sales Brochure.

Yes. You can get term insurance tax benefits up to ₹46,800 with the Canara HSBC Life Insurance Young Term Plan. However, tax benefits will be available per the prevailing Income Tax laws and are subject to amendments from time to time. For tax-related queries, contact your independent tax advisor.

1. Under Plan Option Life Secure of Canara HSBC Life Insurance Young Term Plan, a Special Exit Value benefit is available. The policyholder shall be returned the Total Premiums Paid, excluding the underwriting extra premiums and premiums paid for the Optional In-Built Covers (if any), when the Policyholder surrenders their policy at the earlier of the following:

The period when the attained age of the Life Assured is 65 years (age last birthday); or

‘x’ Policy Year (where x is defined as the 25th Policy Year for Policy Term from 40 years to 44 years and the 30th Policy Year for Policy Terms more than 44 years).

For further applicable conditions, please refer to the Sales Brochure.

Buying term insurance is important for young adults for several reasons. Firstly, it offers lower premiums as they are young and healthy. Secondly, it provides financial protection to dependents ‘in case of an unfortunate event’. Buying a term plan as a young adult can provide financial security and protect loved ones.

0% GST!