Let Your Money Work For You

Beat inflation & build wealth with market-driven growth.

- Market-Linked Returns

- Life Cover

- 13 Fund Options

- Tax Benefits

Start as Low as Rs.2000/month to Build Your Wealth

Enter OTP

An OTP has been sent to your mobile number

Application Status

Name

Date of Birth

Plan Name

Status

Unclaimed Amount of the Policyholder as on

Name of the policy holder

Policy Holder NamePolicy No.

Policy NumberAddress of the Policyholder as per records

AddressUnclaimed Amount

Unclaimed AmountRequest Registered

Thank You for submitting the response, will get back with you.

Request Registered

Thank You for submitting the response, will get back with you.

Thank you for sharing your details. Our financial advisor will connect with you shortly to assist with your financial planning. You will now be redirected to the next step in case you would like to continue on your own..

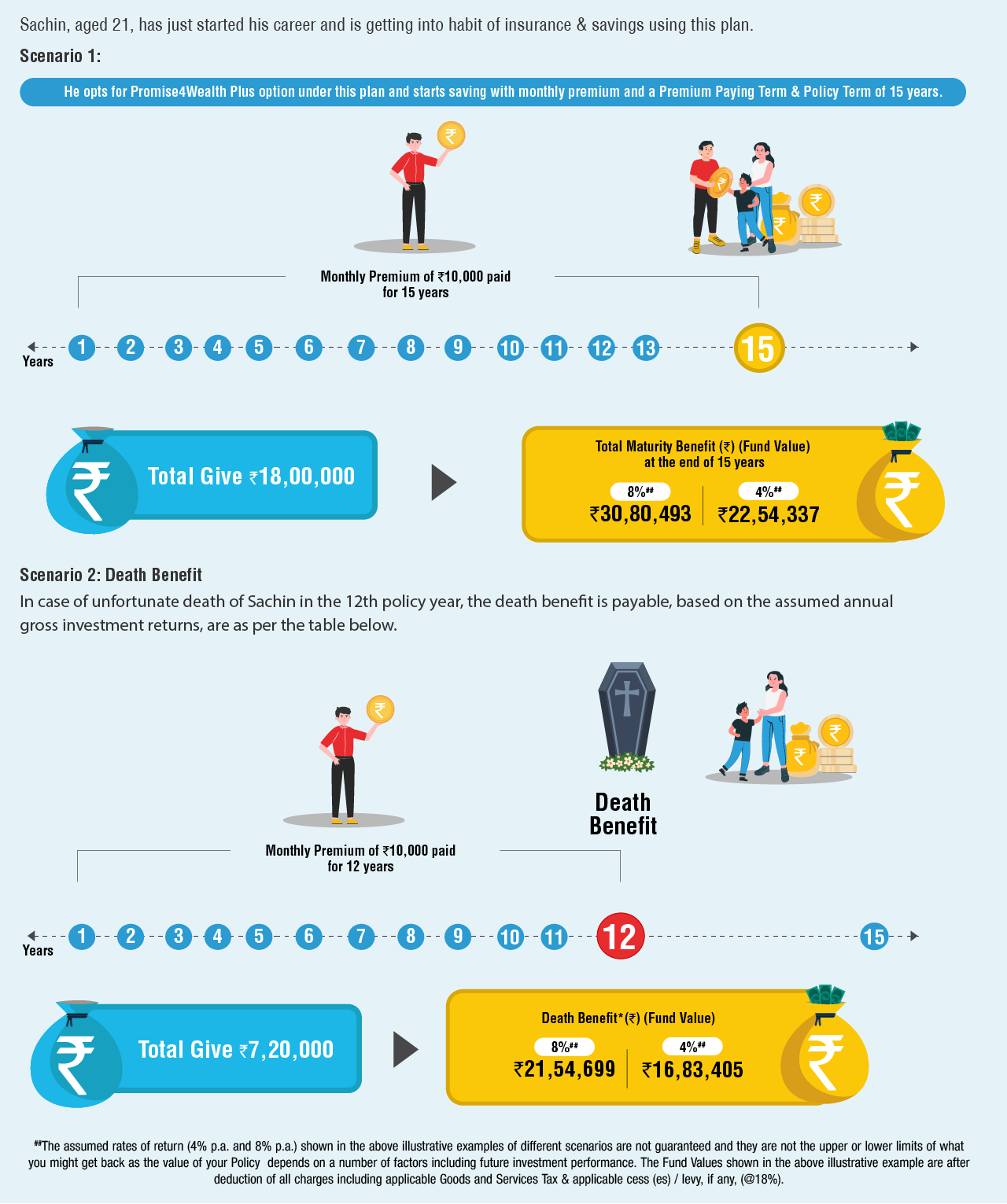

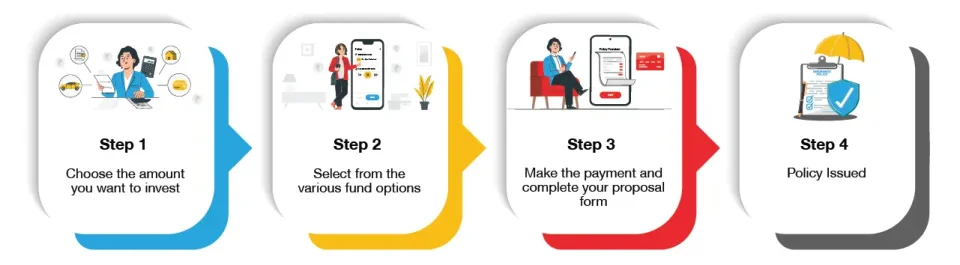

About Promise4Growth Plus

Promise4Growth Plus is designed to turn your disciplined savings into rewarding growth while keeping your family’s future protected. With the twin advantage of market-linked returns and life cover, it helps you stay prepared for dreams, milestones, and uncertainties—so every promise you make today grows stronger tomorrow.

Canara HSBC Life Insurance

We have over 17 years of experience in delivering exceptional value to our customers through our range of individual and group insurance solutions, designed to meet their various needs, including savings and investment, retirement, protection, and more.

15,700+ Partner Branches

15,700+ Partner Branches

Canara Bank, HSBC India, Other Alternate Channels

₹44,089 Cr Assets Managed

₹44,089 Cr Assets Managed

Assets Managed as of Sep' 25

99.43% Claims Settled

99.43% Claims Settled

Individual Death Claims settled for FY 2024 - 2025

197.8% Solvency Ratio

197.8% Solvency Ratio

Way Above the IRDAI Mandate

Plan at a Glance

| Eligibility Conditions | Promise4Wealth Plus | Plan Options Promise4Care Plus | Promise4Life Plus |

|---|---|---|---|

| Entry Age1 | 0 – 65 years | For PPT < 10: 18 – 45 years For PPT >= 10: 18 - 50 years | For PPT < 10: 18 – 55 years For PPT >= 10: 18 – 65 years |

| Maturity Age | 18 – 80 years | For PPT < 10: 28 – 70 years For PPT >= 10: 28 – 75 years | Up till age 100 years |

| Policy Term (in Years) | 10 - 30 years | 10 - 25 years | 100 minus Age at entry |

| Premium Paying Term (PPT) | Limited Pay: 5 to PT-1 years Regular Pay: Same as PT | ||

| Sum Assured | 10 X Annualized Premium2 | ||

| Annualized Premium2 | ₹ 12,000 – No Limit | ||

| Premium Payment Mode3 | Annual, Semi- Annual, Quarterly and Monthly | ||

Note:

- The definition of age used is age as on last birthday. The entry ages given above are only applicable for policies issued with standard mortality rates.

- Annualized Premium means the premium amount payable in a year excluding taxes, rider premiums and underwriting extra on riders, if any

- You may change your Premium Payment Mode anytime during the Policy Term by submitting a written request at least 60 days prior to the next Policy Anniversary. The change in Premium payment mode will be effective only on the next Policy Anniversary. Change in Premium Payment Mode is not allowed post the death of Life Assured under Promise4Care Plus plan option. The Company may accept the first 3 month’s premiums in advance at Policy inception for monthly payment policies. Collection of advance Premium shall be allowed within the same financial year for the Premium due in that financial year. However, where the Premium due in a financial year is being collected in previous financial year, the Premium may be collected for a maximum period of three months in advance of the due date of the Premium. The Premium so collected in advance shall only be adjusted on the due date of the Premium. Such advance Premium, if any, paid by the Policyholder shall not carry any interest.

Frequently Asked Questions

Promise4Growth Plus is a versatile Unit Linked Insurance Plan that combines protection with wealth creation. It offers three flexible variants, market-linked growth opportunities, loyalty additions, wealth boosters, and a return of mortality charges at maturity, helping you secure your life goals while building long-term financial value.

Premiums can be paid annually, semi-annually, quarterly, or monthly, enabling you to align contributions with your cash flow and financial planning.

Yes, you can change your premium payment frequency during the policy term by submitting a written request at least 60 days before the next policy anniversary. The change will take effect from that anniversary. Please note, this option is not available under the Promise4Care Plus variant after the life assured’s death.

Promise4Growth Plus offers a choice of 12 Unit-Linked Funds, spanning equity, multi-cap, debt, liquid funds, and more. Options like Systematic Transfer Plan, Return Protector, and Auto Rebalancing enhance investment flexibility.

There are no premium allocation or policy administration charges. However, fund management charges (0.50%-1.35% p.a.) apply, along with mortality, surrender/discontinuance, and Premium Funding Benefit charges (for select options).

Yes, if the life assured passes away due to suicide within 12 months from the policy commencement or its revival, the nominee will receive the fund value as on the date of intimation of death. Additionally, any charges (except Fund Management Charges) deducted after the date of death will be added back to the fund value. The policy will terminate once this benefit is paid.

Yes, the Promise4Growth Plus plan allows partial withdrawals after a 5-year lock-in. You can withdraw a portion of your fund value, subject to policy terms and limits. It’s useful for emergencies but may reduce overall returns and insurance cover. Always review charges before withdrawing. You can use features like Milestone Withdrawal and Systematic Withdrawal Option for planned liquidity.

If you stop paying premiums in the first 5 years, your fund value (after charges) moves to the Discontinued Policy Fund (DPF) and is paid after the lock-in or on revival. After 5 years, the policy continues with reduced benefits, and you can revive it within 3 years.

The best time is when you seek long-term wealth creation along with insurance protection. ULIPs benefit most when invested early, giving more time for compounding and market growth. Consistent premium payments over 10-15 years help average out market fluctuations, maximising value and protecting your financial goals.

Yes, the Promise4Growth Plus plan includes built-in benefits like Milestone Withdrawal, Systematic Withdrawal, and Premium Fund Advantage.

Yes, premiums paid are eligible for tax deductions under Section 80C, subject to limits. Maturity proceeds and withdrawals may also qualify for tax exemptions under Section 10(10D), provided conditions are met.

Please note: Tax Benefits under the Policy will be as per the prevailing Income Tax laws and are subject to amendments from time to time. For tax-related queries, contact your independent tax advisor.

Returns are market-linked and depend on the performance of chosen funds, such as equity, debt, or balanced. After deducting charges, the Net Asset Value (NAV) determines your fund value. Over time, consistent investment and compounding drive returns. Performance varies with market conditions, so fund choice and investment horizon are key.

To file a claim, submit the claim form with required documents such as policy details, identity proof, and, in case of death, a death certificate. The insurer verifies the documents, processes the request, and settles the claim within regulatory timelines, typically through direct bank transfer.

Yes, you can choose from three variants:

- Promise4Wealth Plus – Focus on wealth creation

- Promise4Care Plus – Includes Premium Funding Benefit in case of loss of life

- Promise4Life Plus – Provides whole life cover up to age 100

Entry Age: 0 to 65 years (varies by variant)

Policy Term: 10–30 years or up to age 100 (for Life Plus variant)

Minimum Premium: ₹12,000 annually

Beat Inflation, Build Wealth