Meet our Advisor

Meet our Advisor

Enter OTP

An OTP has been sent to your mobile number

Application Status

Name

Date of Birth

Plan Name

Status

Unclaimed Amount of the Policyholder as on

Name of the policy holder

Policy Holder NamePolicy No.

Policy NumberAddress of the Policyholder as per records

AddressUnclaimed Amount

Unclaimed AmountRequest Registered

Thank You for submitting the response, will get back with you.

Request Registered

Thank You for submitting the response, will get back with you.

Thank you for your interest in our product. Our financial expert will connect with you shortly to help you choose the best plan.

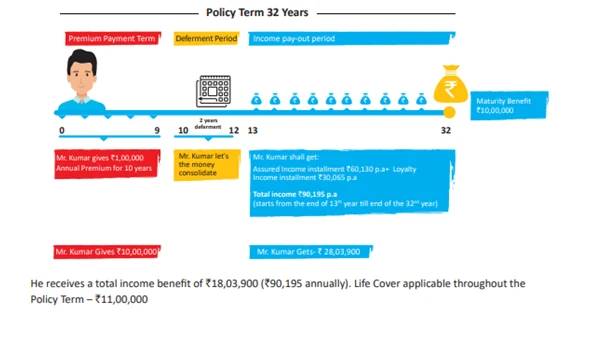

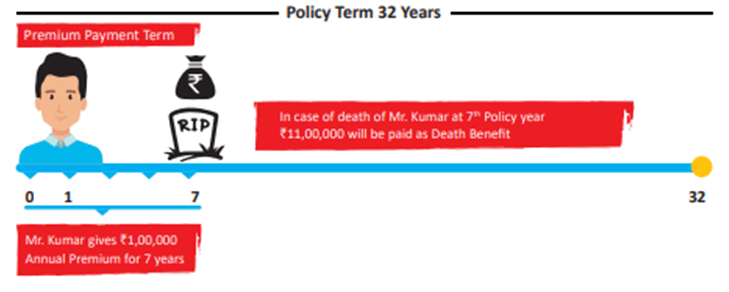

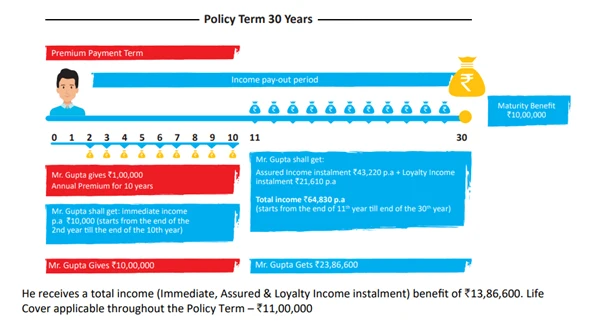

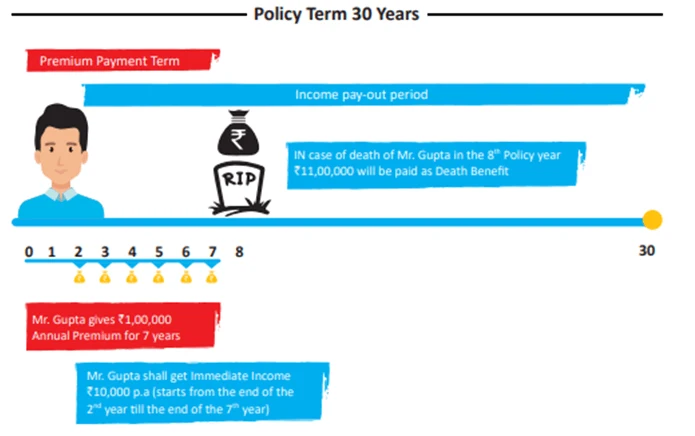

About Guaranteed Assured INcome

A Non-Linked Non-Participating Individual Life Insurance Savings cum Protection Plan

UIN: 136N097V04

We each have unique dreams and goals that we like to pursue and wouldn't it be perfect if our short term, long-term & immediate financial goals in life are aided with guaranteed promises?

Choose Canara HSBC Life Insurance Guaranteed Assured INcome, a plan that provides you, life insurance coverage to achieve financial stability and security for your family and also helps you with an alternate source of savings to take care of your financial goals .The plan gives guaranteed income with the flexibility to get your premiums back at the end of policy term. The plan ensures that your financial goals are met and you are able to give wings to your dreams.

Choose a Plan Option

Depending upon your financial need, you can select your plan option (any ONE) from the following available options under this product.