Written by : Knowledge Centre Team

2025-11-19

2876 Views

6 minutes read

Share

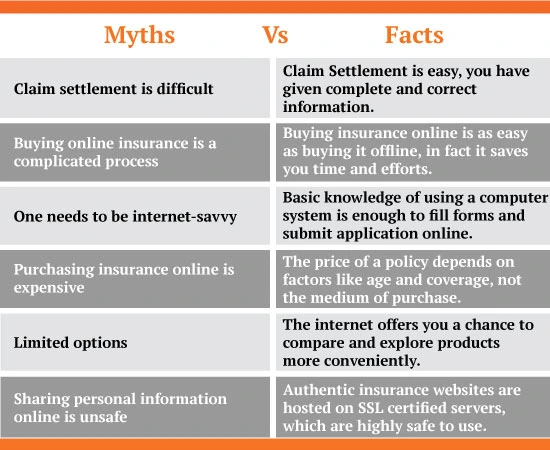

Many Indians are still sceptical about buying insurance and the scepticism only increases when it comes to buying insurance online. Even after more and more people are becoming aware regarding the importance of getting their most valued assets, like car, home, health and life insured, the insecurity with purchasing a policy online remains intact due to the following myths. Let us examine the myths and attempt to bust them

Majority of the people shy away from buying online life insurance due to this myth. However, there is absolutely no difference between the claim settlement process of online policies and policies bought via physical means (face to face sale).

Contrary to popular belief, buying insurance online is a fairly simple process. All it requires is the subscriber having his documents ready and within reach. Just login, select a suitable policy, get your queries resolved, fill up the form and submit your documents. In case the policy requires a medical examination, the insurer will provide you with the information regarding the procedure. The flexibility to buy insurance from anywhere and anytime gives you the freedom that is limited in the traditional method of buying insurance.

One doesn't need to be an expert in interned use to purchase insurance online. One just needs to be internet literate. A basic knowledge of internet and computers like opening a website, logging in and filling out the forms is all that is required for you to successfully purchase an insurance policy online.

It is a general misconception that buying a life insurance policy online is costlier whereas the truth is that it is cost effective. With the absence of agents & middlemen the overall cost of the policies available online gets reduced. Moreover, there are various websites you can use to compare the prices of similar policies offered by different insurance companies and make a smart decision.

When you're purchasing policies online, you have the complete freedom to check, examine and explore as many policies as you like whereas if you are dealing with an agent, you'll have to take his/her word for everything. Therefore buying policies online doesn't leave you with limited options; rather it allows you to explore a multitude of choices to opt from.

All the websites of insurance companies are hosted on SSL certified servers, which are highly secure and virtually difficult to hack. Therefore, you have nothing to worry about while sharing your personal details with them as these servers ensure the security of your personal data and financial transactions.

Now that the most prevalent myths related to purchasing insurance online have been busted, to browse through some of the best online insurance plan offered to you by Canara HSBC Life Insurance and give your family the gift of financial stability.

An OTP has been sent to your mobile number

Sorry ! No records Found

Thank You for submitting the response, will get back with you.

Disclaimer - This article is issued in the general public interest and meant for general information purposes only. The views expressed in this blog are solely those of the writer and do not necessarily reflect the official policy or position of Canara HSBC Life Insurance Company Limited or any affiliated entity. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the blog or the information, products, services, or related graphics contained in the blog for any purpose. Any reliance you place on such information is therefore strictly at your own risk. You should consult with a qualified professional regarding your specific circumstances before taking any action based on the content provided herein.

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling online insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.