Written by : Knowledge Centre Team

2025-08-02

879 Views

8 minutes read

Share

The novel coronavirus started emerging as a viral pathogen in December 2019, but now the virus has strengthened its grip and has started spreading across the globe, leading to a serious health issue. It has been declared as a pandemic by the World Health Organization (WHO) considering the possibility that it is likely to affect a large number of populations. In order to prevent the spread of this deadly virus, India, like most other countries, has declared a state of lockdown, permitting only essential services to continue. The pandemic has not just impacted us in terms of health but also adversely affected businesses, trades, and economies worldwide.

Insurance has been synonymous with just life insurance for a long time in India. Particularly, for the people residing in smaller towns and villages, insurance is seen as a tax-saving instrument for the working class. However, Covid-19 has brought about a shift in demand and supply. The fear and the uncertainty of life, as well as high-priced Covid-19 medical expenses, have made people opt for term plans and medical insurance over life.

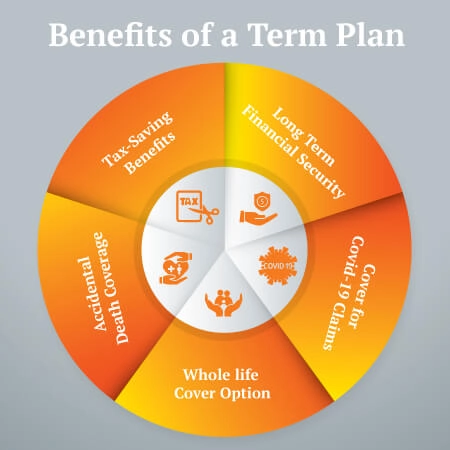

Corona virus has created a sense of urgency for most people who used to repeatedly postpone their health insurance buying decision. They have seen the usefulness of having a health cover and also realize the need of financial planning for a secure future of their loved ones. Therefore, Term insurance plans, such as the iSelect Smart360 Term Plan by Canara HSBC Life Insurance, offering financial coverage and several additional benefits has become popular.

The Covid-19 pandemic has led to increased awareness, or rather made people more interested in conversations around insurance, its benefits and need. As people come to terms with the unpredictability of the whole situation, and its financial and emotional impact on their well laid plans, insurance is emerging as one of the definite ways to financially protect themselves and their families.

With the increasing insecurities about health and life, Insurance policies are likely to become entrenched in our lifestyles. Insurance will become important than ever before, marking a significant shift from being purchased for mere tax-saving or compliance benefit to the core purpose of protection that term plans are supposed to serve.

In the post-Covid-19 environment, one can anticipate a clear change in how consumers buy insurance policies with respect to the adoption of digital technologies.

While the transformation of making India digital was already in progress, the current situation has accelerated the pace of change. As we work our way towards a new normal, term and life insurance will become pivotal pillars for the consumers to stay protected, while life insurance providers will have to provide attractive benefits and relevant protection plans in order to keep up with the pace. And for all of us together, this is the time to harness the power of good health and define the future of insurance in India.

An OTP has been sent to your mobile number

Sorry ! No records Found

Thank You for submitting the response, will get back with you.

Disclaimer - This article is issued in the general public interest and meant for general information purposes only. The views expressed in this blog are solely those of the writer and do not necessarily reflect the official policy or position of Canara HSBC Life Insurance Company Limited or any affiliated entity. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the blog or the information, products, services, or related graphics contained in the blog for any purpose. Any reliance you place on such information is therefore strictly at your own risk. You should consult with a qualified professional regarding your specific circumstances before taking any action based on the content provided herein.

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling online insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.