Written by : Knowledge Centre Team

2025-08-02

887 Views

8 minutes read

Share

COVID-19 has brought challenges in our lives nobody expected to face, at least in their lifetimes. Almost all public places shut, social gatherings restricted and normal economic life disrupted beyond recognition are just a few points of the ongoing legacy of this pandemic. Education has been one of the worst affected sectors.

The performance of the education sector is not just important from the present point of view, but the future as well. Its impact would ripple across the next few decades as children lose the learning time now.

Does this mean education expenses would change? Or the cost of higher education will change? It is likely, however, we should look at the bigger picture than simply looking at the tuition fees. Read on to find how a Unit-linked Insurance Plan can help you save for your child’s education.

We already have a glimpse into what the future education environment will look like. Few prominent traits of the new normal in education after Covid-19:

Unless you preferred the traditional mode of learning for your child, you probably had access to all these technologies already. Still, turning luxury into necessity may take time to become the new normal.

More than the access to technology, your child will need the correct environment to continue the learning curve.

With the digital-first approach, you will increasingly find online platforms as the new school and higher-education providers. Especially with the higher education courses, these platforms will become the primary source of knowledge and certification.

In the traditional framework of higher-education, infrastructure played an important role, both in imparting knowledge and expenses. With the digital distribution, of course, your tuition expenses will certainly fall, but most other expenses will also become personal.

For example:

However, the online mode of learning cannot replace classroom mode entirely. Also, efforts are one to reduce student density in the classrooms to keep the social distance. That would only mean higher costs for classroom study.

Not to mention the efforts to build immunity against the disease and finding a cure. The education professionals understand that classroom mode of learning is more effective and enables interaction. Additionally, institutional infrastructure is necessary for many professional education experiences like engineering.

So, you can expect the classroom mode to return sooner or later.

With an uncertain future and evolving situation at hand, a conservative approach will do better. So, if you are starting to invest for your child’s higher education goal some 15 years away, you need to continue the investment as planned.

Even though many foreign and Indian institutions have revised their fee structure in the face of new developments, chances are they will return to old norms once the demand returns. So, this may not be the correct time to revise your financial goals.

Your child’s education goal is one of the most important goals of his/her life and an ideal savings plan can ensure you are well equipped to meet it. It will define where they end up in society and financially in the future. Thus, you need an investment option, which not only helps you build the corpus but also helps you to secure the goal.

ULIP investment plans from Canara HSBC Life can provide both returns and safety for your child’s goal. Consider the following case to understand how the ULIP investment plan works:

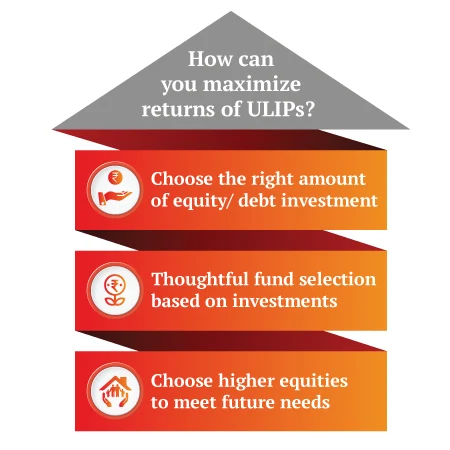

If your goal is to accumulate Rs. 50 lakh for your child’s education in 15 years, you will need to invest about Rs. 15,000 per month if your rate of return is 8%. Now ULIP gives you the following features to help you reach the goal faster:

Boosters to add a bonus to your portfolio if you invest diligently for more than five years.

15 years is a good time to boost your returns with equity funds. ULIP plan gives you multiple portfolio management strategies to benefit from equity markets.

ULIP plans not only give you the options for growth, but they also have the option to safeguard your goal. Here are few features of ULIP plan can boast of in this direction if you have opted for goal safety:

Thus, you can choose features and benefits in the ULIP plans which will not only help your child meet her goal while you are there but also when you are not. Also, let’s not miss the point that all of this is possible with full tax-exemption. All you need to do is ensure that your annual investments in the plan stay below 10% of the sum assured of the policy.

An OTP has been sent to your mobile number

Sorry! No records Found

Thank You for submitting the response, will get back with you.

Thank You for submitting the response, will get back with you.

Thank you for your interest in our product. Our financial expert will connect with you shortly to help you choose the best plan.

Disclaimer - This article is issued in the general public interest and meant for general information purposes only. The views expressed in this blog are solely those of the writer and do not necessarily reflect the official policy or position of Canara HSBC Life Insurance Company Limited or any affiliated entity. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the blog or the information, products, services, or related graphics contained in the blog for any purpose. Any reliance you place on such information is therefore strictly at your own risk. You should consult with a qualified professional regarding your specific circumstances before taking any action based on the content provided herein.

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling online insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.