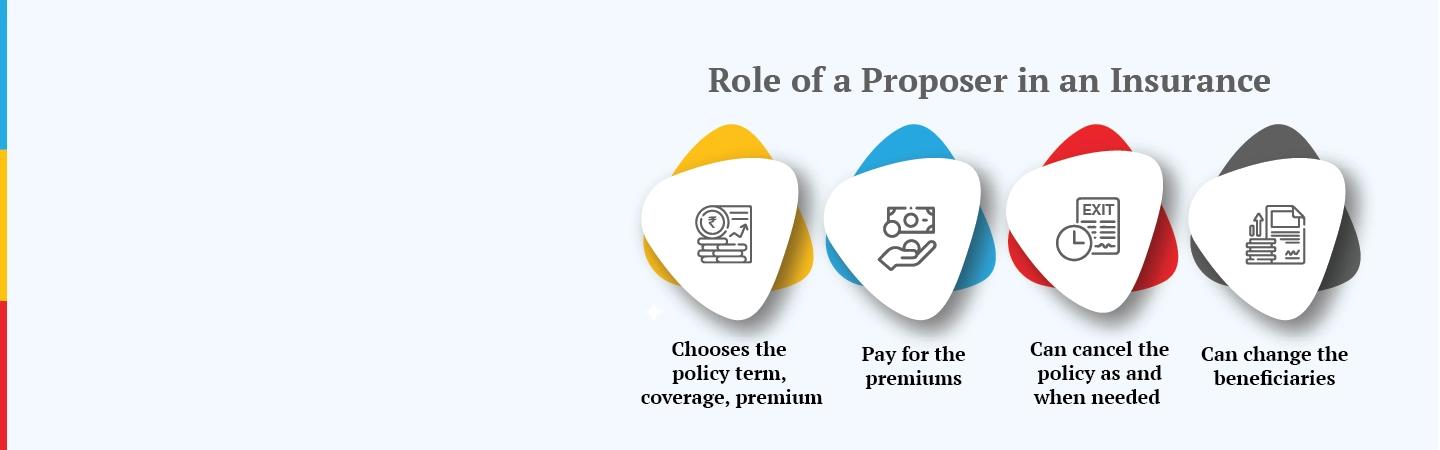

- Proposer: The person who applies for the insurance policy, provides details and pays the premium

- Insurer: An IRDAI-registered company that provides the policy and covers financial risk as per the terms

- Insured: Person whose life is covered under the insurance policy

- Proposal Form: Official form submitted to the insurer containing personal, health or asset details for underwriting

- Nominee: Person chosen by the insured to receive benefits if a claim arises due to the death of the insured

Written by : Knowledge Centre Team

2025-12-24

3500 Views

10 minutes read

Share