Understanding ULIP vs SIP

Before we draw the conclusion about which is better for your surplus funds, ULIP or SIP, let's understand what each entails.

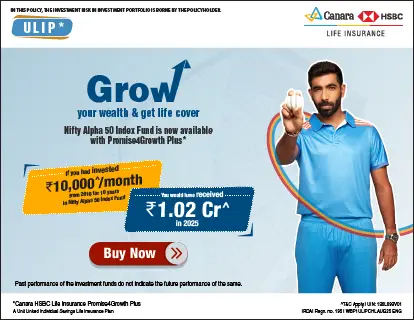

A ULIP insurance plan is a hybrid financial product that offers life insurance cover and investment. A portion of your premium pays for the life coverage and other plan charges, while the remaining amount is used as an investment in funds of your choice. It can be in equity, debt, or a balanced portfolio, much like mutual funds.

The value of your investment is represented by 'units', which fluctuate based on market performance. They typically come with a lock-in period, usually five years, before which withdrawals are restricted or not allowed. Many individuals use an online calculator to project potential returns based on assumed growth rates and to understand the impact of various charges.

An SIP is not a product itself, but a method of regular investments in mutual funds. You commit to fixed amount investment at regular intervals (weekly, monthly, quarterly) into a chosen mutual fund scheme. SIPs are popular for promoting disciplined investing.

The investment benefits are generally from rupee cost averaging. In addition, the power of compounding over the long term also helps grow the investment. They are purely investment vehicles and do not inherently come with an insurance component.