- Market Sentiment: The overall mood or tone of investors in the market, driven by news or emotions, influences buying and selling.

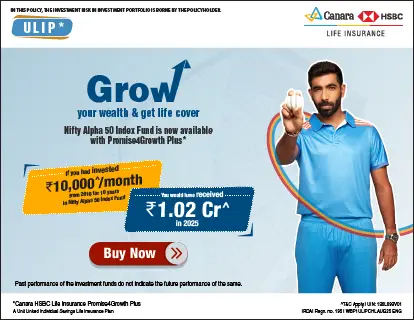

- ULIP Schemes: A financial product combining life insurance and market-linked investments with tax benefits.

- Portfolio: A mix of financial assets like stocks, bonds, and funds owned by an individual to grow wealth or manage risk.

- Equity: An ownership share in a company, often purchased as stocks, offering growth potential but with higher market risk.

- Debt Funds: Investments primarily in fixed-income securities like government or corporate bonds, ideal for stable, low-risk returns.

Written by : Knowledge Centre Team

2025-07-21

2775 Views

12 minutes read

Share