Table Of Content:

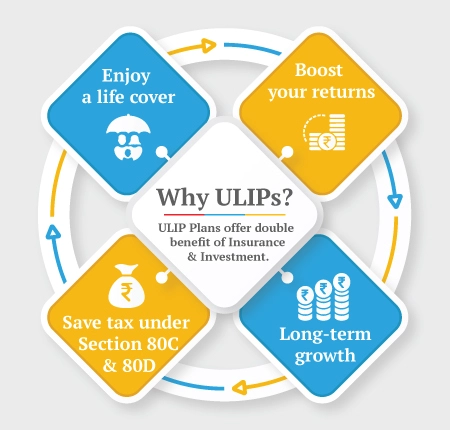

ULIP - known as Unit Linked Insurance Plan- offers dual investment and life insurance benefits.

Investing in the best ULIP can help you achieve long-term wealth creation and life coverage. ULIP is the best investment option to meet your financial goals. Buy ULIP from Canara HSBC Life Insurance to get life cover, multiple portfolio management options, flexible premium paying options, tax benefits, and a wide array of other benefits.

Key Takeaways

|

What is a ULIP?

The full form of ULIP is Unit Linked Insurance Plan. A ULIP is an insurance product that provides you with the double benefit of investment to achieve long-term wealth creation goal, and a life cover to secure your family’s future if there is an unfortunate event. The premium paid for ULIP is divided into two parts. One part of the premium is used for your life cover and the remaining sum is invested in the fund of your choice. In ULIP plans, you can invest your money in equity, debt or a combination of both funds depending on your risk appetite. The returns on the investment depend upon the performance of the funds.

Features of ULIP Plans

- Flexible investment options: With ULIP, you have the flexibility to select your fund as per your risk appetite. ULIP come with a variety of funds to choose from. Investors with a low risk appetite can invest in debt funds while those with a high risk appetite can invest in equity funds.

- Lock-in period: ULIPs come with a lock-in period of 5 years and offer good returns on investment over a long period of time. So, it can be said that the longer you stay invested in a ULIP, the better it may become for your investments.

- Premium payment options: You can choose a single premium (one-time lump-sum payment at policy inception), a limited premium (payments for a fixed period with continued coverage), or a regular premium (payments made throughout the policy term).

- Liquidity: ULIP also allows you to do partial withdrawals when you need them after the completion of the lock-in period.

Simply put, ULIP provide liquidity only after the lock-in period is over.

Turn Small Investments Into Big Wealth with ULIP

Enter OTP

An OTP has been sent to your mobile number

Application Status

Name

Date of Birth

Plan Name

Status

Unclaimed Amount of the Policyholder as on

Name of the policy holder

Policy Holder NamePolicy No.

Policy NumberAddress of the Policyholder as per records

AddressUnclaimed Amount

Unclaimed Amount

Sorry ! No records Found

Request Registered

Thank You for submitting the response, will get back with you.

Thank You for submitting the response, will get back with you.

How Does a ULIP Plan Work?

A ULIP acts as both an insurance policy and an investment avenue. A ULIP has a pre-decided death benefit, which is paid to the nominee in case the unfortunate happens. In addition, if the policyholder survives the term of the ULIP, they receive the maturity value of the ULIP, which is the amount generated by the ULIP investments in equity and debt funds.

While the maturity benefit is subject to market-linked risks, the insurance cover under a ULIP remains fixed. Like any other insurance, you need to pay a premium for a unit-linked insurance plan. In ULIP, the insurance company deducts an amount of your premium towards life cover and the rest is invested in a number of qualified funds. Afterwards, you get returns based on the performance of the funds you opted for. There are several investment options such as debt, equities, hybrid funds, etc., for you to choose from.

The total investment made is then divided into the 'units' with a unique face value, and every investor is allocated 'Units' based on their invested amount.

Unit Linked Insurance Plan or ULIP is a one-stop option for those looking for a long-term investment instrument that offers both transparency and flexibility. Also, it’s a perfect choice for those looking for a cost-effective way to enter the investment market. ULIP come with a range of fund options that help meet the policyholder's investment needs. Besides, here are few more reasons that show the need to buy a ULIP scheme:

- To avail tax benefits: If you are looking for an investment instrument that helps you save on taxes, then ULIP is the best bet for you. You can enjoy tax benefits on the premiums that you pay towards the policy as per Section 80C of the Income Tax Act. Also, death benefits paid under the plan are exempt from tax as per Section 10D of the Income Tax Act.

- To enjoy dual benefits packed in a single plan: It offers a dual benefit of insurance and investment in a single policy. A ULIP plan not only offers life cover that protects your family against financial difficulties but also provides numerous investment instruments that help you maximise your returns.

- Higher Returns: ULIP offers higher returns offering a range of investment options to choose from. This includes debt funds, equity funds, etc. You can choose any of these based on their performance and your risk appetite. You are also allowed to switch between funds based on the market outlook.

- Long-term wealth creation: If you want to meet your long-term financial goals, then switch to ULIP. It comes with a lock-in period of 5 years that keeps you invested for a longer tenure. This accumulated money helps you meet your long-term financial goals such as buying a house or car, children’s education, marriage or other major financial objectives.

What are the Different Types of ULIP?

Given below are the different types of ULIPs:

Based on Funds:

A ULIP typically offers multiple types of funds, each with a distinct investment strategy. The funds you choose within the policy are invested in various financial instruments like equities, bonds, or money market instruments. Here’s a breakdown of the various types of ULIP based on the funds they offer:

- Equity Funds: Equity funds are one of the most common options in ULIP that primarily invest in stocks and equity markets, providing high growth potential. Due to their focus on equities, these funds tend to be riskier compared to other types, but they offer potentially higher returns over the long term.

- Debt Funds: Debt funds in ULIP are designed to provide more stable returns by investing in fixed-income instruments like bonds, government securities, or corporate debt. These funds are less volatile in comparison to the equity funds and offer lower but more predictable returns.

- Balanced Funds: Balanced funds or hybrid funds aim to strike a balance between equity and debt. These funds typically allocate a portion of the corpus in equities for growth potential and the rest in debt for stability and income. They are designed to offer a moderate level of risk and return.

- Liquid Funds: Liquid funds are designed to offer a high level of liquidity and stability by investing primarily in short-term debt instruments like Treasury Bills, certificates of deposit, and commercial papers. These funds are ideal for individuals who want to maintain easy access to their money while earning a stable return.

Based on Structure:

The different types of ULIP can be broadly categorised based on their structure, which dictates how the funds are managed and what benefits are offered. These structural variations allow you to choose a plan that aligns with your financial goals, risk tolerance, and life-stage needs. Below are the primary types of ULIP based on their structure:

- Traditional ULIP: Traditional ULIP are designed to provide guaranteed life insurance coverage along with investment options. While these ULIP combine life insurance with investment, the primary feature of a traditional ULIP is life coverage, with the investment aspect playing a secondary role.

- Market-Linked ULIP: Market-linked ULIP are structured to take advantage of the performance of the financial markets, with a larger portion of the premium being invested in equity and market-driven funds. These plans offer greater growth potential but also come

with higher risk due to their dependence on the market's performance.

- Hybrid ULIP (Balanced ULIP): Hybrid ULIP are a combination of both traditional and market-linked ULIP. These plans offer the best of both worlds by investing in both equity and debt instruments. The equity portion aims for higher returns, while the debt portion provides stability and reduces the overall risk.

- Pension ULIP (Retirement Plans): Pension ULIP, also known as retirement ULIP, is structured to help individuals build a corpus for their retirement years. These plans focus on long-term savings and wealth creation, with the primary goal of securing the policyholder’s financial future after retirement.

- Child ULIP: Child ULIP are specially designed to secure the future of a child, both in terms of education and financial security. These plans are typically structured to accumulate a large corpus over a long investment period, providing a mix of life insurance and market-linked returns.

How to Choose the Right ULIP Fund in India?

| Investor Type | Types of ULIP Suited |

|---|---|

| Risk-Taking Investor | If you have a high-risk appetite, then invest in equity instruments. They offer great returns, but also have high risk. |

| Risk-Averse Investor | If you have low-risk appetite, then invest in debt funds such If you have low-risk appetite, then invest in debt funds such as fixed income bonds, corporate bonds, etc. They offer fewerl returns and the risks associated to them are also low. |

| Moderate Risk Investor | If you are ready to take risks but not too much, then invest in balanced funds. Thus, lowering the risk factor. |

The Most Suitable ULIP Plans in India 2026

| Product (UIN) | Fund Options | Growth Enhancers / Value Additions | Charge Details | Life Cover & Safeguard Features | Payout & Tax Advantages | CTA |

|---|---|---|---|---|---|---|

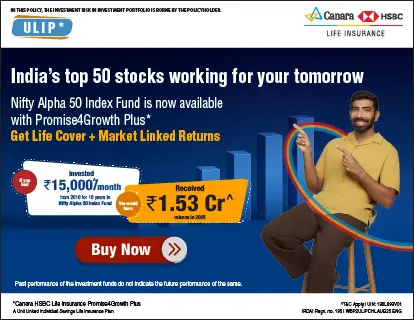

Canara HSBC Life Insurance Promise4Growth Plus (136L093V01) | 13 Fund Options | Return of Mortality Charges (RoMC) added back at maturity | No Premium Allocation Charges No Policy Administration Charges | Premium Funding Benefit (future premiums paid by insurer in case of death) | Fund Value payable at maturity; tax benefits as per prevailing laws | Check Plan Details |

Canara HSBC Life Insurance SecureInvest (136L092V01) | 12 Fund Options | Loyalty Additions from year 10; Maturity Booster | Get twice the Premium Allocation and Mortality Charges added back to your Fund. | High life covers up to 100× annualised premium | Premiums and returns qualify for tax benefits as per the prevailing Income Tax Act, 1961. | Check Plan Details |

Canara HSBC Life Insurance Wealth Edge (136L085V03) | 10 Fund Options + 5 portfolio strategies | Return of Mortality Charges + Loyalty Additions + Wealth Boosters | Loyalty Additions: 0.5% of the average fund value added yearly from the 6th policy year onward. | Life cover till age 100; waiver of future premiums in case of death if the fund stays invested (in case of premium plus variant) | Fund value at maturity; tax benefits as per law | Check Plan Details |

Benefits of Investing in ULIP Insurance Plan

- Flexibility: ULIP allows you to switch to a different investment option. This can be useful if you do not have fixed financial goals and you want to shift from one fund to another. It provides you with high flexibility as it allows you to control where and in what proportion your money will be invested. The following features provided by ULIP do this:

- Fund Switching Option: Through the use of this feature, you can move your money between funds as you like. For example, you have invested a major part of the money in equity funds and now you want to transfer the some to safer debt funds. Fund switch allows you to do that.

- Redirection of Premium: ULIP provides you with a host of funds to invest your money. If you have invested in one fund earlier and now you no longer find it suitable. You can still choose another fund and the next premium will be redirected to that fund.

- Partial Withdrawal Facility: This option gives you chance to withdraw part of your funds if you want.

- Top-up Facility: Through this feature, you can add additional funds to your existing investment without changing the policy.

- Transparency: It offers transparency. With ULIP, you don't have to worry about the hidden changes or fees. All charges such as management of funds, policy administration, etc are disclosed upfront before you buy the product.

- Tax benefits: ULIP are efficient tax-saving instruments. The premium that you pay towards the policy is exempt from deduction under section 80C of the Income Tax Act.

- Ideal for long-term investment goals: It is perfect for long-term investment objectives. Before investing in the ULIP plan, it is advisable to make a list of your long-term financial goals that you want to fulfil through investment. Goals such as funding for your kid's higher education, purchasing a house, your child's marriage, etc.

- Market-Linked Returns: Returns that you can earn through a ULIP policy are market-linked. Returns vary according to the performance of the chosen asset in the market. The Premium you pay is invested in funds. These funds invest in different market securities according to your choice. You can either invest in debt, equity, or even a mix of both. Keep a close check on the NAV of securities to watch the returns.

- Death Benefits: Since Unit Linked Insurance Plans offer you insurance, they provide death benefits as well. This refers to the amount your family will receive in case you die during the policy. The death benefit is not the same and varies according to the cause of death. It is usually higher than the sum assured and the fund value at the time of death.

- Maturity Benefits: Apart from the death benefits, ULIP gives you maturity benefits as well. If you manage to survive the term of the policy, you are entitled to receive the maturity benefits. This is the value your fund has attained throughout the policy term. The more your fund grows, the higher the benefits you get.

- Withdrawal Benefits: This benefit allows you to partially withdraw from your unit-linked insurance plan. This comes in handy during situations when you require money. You can withdraw from your investment at no additional charge after the lock-in period is completed. These withdrawals are tax-free.

Unit Linked Insurance Plans - Top Selling Plans

Canara HSBC Life Insurance offers online ULIP plans that blend life insurance protection with investment growth, helping you build wealth while securing your family's future.

Wealth Today, Protection Always

- Life Cover up to 100 Years

- 13 Fund Options

- Fund Switching Option

- Waiver Of Premium

Secure Your Future with Confidence

- Life Cover up to 100× Annual Premium

- 12 Fund Choices

- Automated Portfolio Strategies

- Maturity Booster

Invest Smart, Live Smart

- Flexible Premium Options

- Multiple Fund Allocations

- Systematic Withdrawals

- Premium Waiver Benefit

How to Claim Tax Benefits for your ULIP?

Claiming tax benefits for your Unit Linked Insurance Plans (ULIP) is relatively straightforward, but it's essential to understand the key sections under the Income Tax Act that apply to ULIP.

Under Section 80C, the premiums paid towards your ULIP are eligible for a tax deduction of up to ₹1.5 lakh per year, helping reduce your taxable income.

Additionally, Section 10(10D) provides that the maturity and death benefits from ULIP are typically tax-free, provided certain conditions such as the premium not exceeding 10% of the sum assured are met.

To claim these benefits, ensure you maintain all relevant documents, such as premium receipts and policy details. When filing your tax returns, you’ll need to declare the premium paid under Section 80C, and the maturity or death benefits under Section 10(10D) will automatically be exempt from tax. If you surrender your policy, ensure that it meets the criteria for tax-free treatment, especially if the lock-in period is over. Consulting a tax professional is always a good idea to ensure you are maximising your tax-saving potential from your ULIP.

ULIP Fees and Charges

Unit Linked Insurance Plan or ULIP is an insurance-cum-investment plan that not only offers life cover but also allows you to invest in several asset classes. Before investing in a Unit-linked Insurance Plan, you need to know about the charges that you have to pay for the entire policy term. The structure/applicability of charge may differ from one insurer to another, but here are some of the most common ULIP charges and fees:

Premium allocation charges:This is a fixed percentage that is reduced from the premium at a higher rate in the starting years of a policy. This fee is charged by the insurance company before allocating the policy. This includes charges such as initial and renewal expenses, medical expenses, etc |

Policy administration charges:Insurance companies impose policy administration charges that are deducted on a monthly basis. Such charges are imposed for managing the administration of your policy. |

Fund management charges:As the name suggests, fund management charges are imposed for managing your funds so that you earn potentially higher returns. |

Partial withdrawal charges:ULIP provide partial withdrawal of funds that allows investors to withdraw money partially. However, such withdrawals attract penalty charges. |

Mortality charges:These charges depend upon a number of factors such as age, amount of sum assured, etc. For instance, if you are buying a policy at the age of 25, then your mortality charge will be lower because life expectancy of a 25-year-old is higher than that of a 50-year old. This charge will be deducted every month. |

Switching charges:Moving your investments from one fund to another is called switching in ULIP. It allows investors to switch between funds every year on the basis of their performance and risk appetite. However, depending on the insurance company’s charge structure, each switch would attract some charges. |

Rider charges:These type of charges are levied on additional riders. For example, if you want to opt for a critical illness rider, you will have to pay extra charges. |

Surrender Charges:These charges will be imposed if you decide to discontinue your ULIP policy. You will have to pay surrender charges only if you want to discontinue within the lock-in period. No charges apply after the lock-in period has been completed. Surrender charges are levied on the total value of the fund. |

How to Effectively Manage ULIP Investment Plans?

Unit Linked Insurance Plan or ULIP is a long-term investment instrument that helps you achieve your dreams in a robust and effective manner. Although, to make the most out of your Unit Linked Insurance Plan, you need to learn how to manage it wisely. You need to ensure that your returns are balanced out so that any loss caused by one asset class is covered by the other. Therefore, it minimises the overall risk of your investments. Here are some tips that will help you manage ULIP effectively

1. Balance between equity-debt portfolio: ULIP as an investment plan allows you to switch between assets. Each asset has different characteristics like equity funds, whichare ideal for investors who like taking risks. It happens to be riskier than other funds but offers higher returns. On the other hand, debt funds offer the least risk but also low returns. It is perfect for those investors who are risk-averse. Thus, you need to balance the investment portfolios.

2. Stay updated with the market : It is advisable to keep yourself updated with the market trends and economic scenarios as this will help you make better decisions. For example, if you have invested in equity funds, but due to the change in market trends, the equity market looks overvalued and costly, you can switch out of equity funds and switch back when the market is normal.

3. Understand life stage needs : Choosing between equity and debt funds mainly depends on your life stage needs. Thus, policyholder needs to understand which life stage they are on as they get more risk-averse with time. Therefore, you should try to switch from equity funds to less riskier debt funds as you get older.

Overall, ULIP is a market-linked insurance plan. Keeping the market fluctuations in mind, you need to manage them properly in order to reduce risks and gain higher returns.

How to Choose the Best ULIP Plan?

- Choose the fund option that aligns with your goal: ULIP policies provide you with the flexibility in choosing the funds you want. It will be better if you choose the fund options that can help you reach your goal effectively. Investing in equity can grow your funds higher in the long term but it also has a high risk involved. Whereas debt funds are safer and less reactive to market changes, but returns are safer, lesser. So, it is necessary to identify the goal first and then choose the fund accordingly.

- Choose a suitable life insurance cover amount: Other than providing the opportunity of investment, ULIP provides you with life coverage as well. This helps in securing your family in case something happens to you. So, in this regard, you must choose a life cover that will be sufficient for your family to achieve their goals.

- Stay for as long as you can under your ULIP: ULIP are a long-term investment plan. So, it can give you the best results when you stay invested longer. This is why ULIP have a lock-in period of 5 years. The longer you stay in the policy, the more time you are giving your investments to grow. This will allow you to create huge wealth due to compounded returns.

- Maximum tax saving benefits of ULIP: ULIP plans provide you with tax benefits. There are deductions as per the Income Tax Act 1961 available under various sections if you have invested in ULIP. These involve

A deduction of up to ₹ 1.5 Lakh is available on the premium that is paid towards the policy under section 80C.

Also, the maturity, as well as the death benefits received, are tax-free under section 10(10)D.

Things to Keep in Mind Before Investing in a ULIP Plan

- Risk Appetite: You must know your risk appetite before investing in a ULIP. This plan comes with a wide range of funds to select from based on your needs and risk appetite. Those who are reluctant to take risks can invest most of their investment in debt funds while those who like to take risks can go for equities.

- Charges in your ULIP: This investment cum insurance plan comes with a set of charges. Thus, before purchasing the policy, you need to understand the following charges:

- Mortality/Morbidity Charge

- Policy Administration charge

- Fund Management charge

- Premium Allocation charge

- Flexibility: ULIP offers you the flexibility to switch between the funds. While buying a ULIP investment, you must consider the cost of switching, ease of switching, and complimentary switches during the policy period.

- Premium Payment Option: ULIP basically offers three types of payment options - single, limited, and regular. Therefore, compare and choose a plan that you are comfortable with.

Avoid These Common Mistakes When Buying a ULIP

ULIP are popular financial instruments that offer a flexible and tax-efficient way to build wealth. However, they can be complex and often lead to mistakes that can affect the returns or the effectiveness of the policy. To maximise the benefits of a ULIP, it’s important to be aware of common pitfalls that are listed below and avoid them when making your purchase.

- Not Understanding the Cost Structure: ULIP usually comes with various charges such as premium allocation charges, fund management fees, mortality charges, and administration charges. Failing to factor these into your decision can lead to surprise deductions from your investment returns. Always ask for a detailed breakdown of these charges and evaluate how they might impact the overall growth of your investment.

- Ignoring the Lock-In Period: ULIP typically comes with a lock-in period of five years, meaning you cannot withdraw your investment or make major changes during this time. Many investors overlook this aspect and may want to withdraw or make changes before the lock-in period ends, which could incur penalties or reduce the overall returns. Be sure you are ready for a long-term commitment before opting for a ULIP.

- Overlooking the Fund Options and Risk Profile: Not all ULIP are the same, and each policy comes with a variety of investment options ranging from equity to debt or balanced funds. A common mistake is to invest in a fund that doesn't match your risk tolerance or financial goals.

- Focusing Too Much on Short-Term Performance: ULIP are long-term financial products, and their performance needs to be evaluated over several years rather than in the short term. Many investors make the mistake of monitoring the short-term fluctuations in the Net Asset Value (NAV) and making hasty decisions based on market movements. ULIP are designed to deliver growth over the long term, and reacting to short-term market conditions can lead to missed opportunities for growth.

- Forgetting About the Switching Charges: Many ULIP allow policyholders to switch between funds (equity, debt, or balanced), but frequent switching can attract charges. While switching can be a good strategy during market fluctuations, overdoing it can lead to unnecessary costs. Evaluate the switching charges and try to limit the number of changes to maintain your investment's cost-effectiveness.

How to Choose the Right Cover Amount in a ULIP Plan?

| Factors To Decide | Example |

|---|---|

| Current Income | At the current income level of ₹ 5 Lakh per annum, opt for a life cover that provides coverage of ₹ 1 Crore. |

| Age | If your age is b/w 20-30 years, buy a life insurance cover of 15 times your annual income while if you are b/w 45-55 years, buy a life insurance cover of 10 times your annual income. |

| Financial Liability | Ensure your life coverage is enough to cover your financial liabilities like outstanding debts, mortgages, education loans, etc. |

| Inflation Rate | In 15 years, at 7% inflation rate, the value of ₹ 1 crore would whittle down to an equivalent of ₹ 33 Lakh in present terms |

| Life Goals | Know your financial goals such as your child’s education, marriage, sustaining lifestyle, etc., while deciding on your life insurance coverage. |

Are there any Riders Available with ULIP?

Yes, ULIP offers a range of additional riders that can be added to your policy to enhance its coverage and benefits. These riders are supplementary benefits that allow you to customise your ULIP plan according to your specific needs and financial goals. Here's an overview of the most common riders available with ULIP:

- Accidental Death Benefit Rider: This rider provides an additional sum assured in case of the policyholder’s death due to an accident. It enhances the death benefit and ensures the financial security of the policyholder’s family, particularly if the death occurs in unforeseen circumstances. The Accidental Benefit rider is especially valuable for individuals who are at higher risk due to their occupation or lifestyle.

- Critical Illness Rider: A critical illness rider offers a lump sum benefit if the policyholder is diagnosed with a major illness such as cancer, heart attack, stroke, or kidney failure, among others. This rider helps cover the high medical expenses associated with treatment and can be a crucial addition for individuals looking to secure themselves against life-threatening health conditions.

- Waiver of Premium Rider: In case of disability or critical illness, this rider waives the future premiums on the ULIP, ensuring that the policy remains active even if the policyholder is unable to pay premiums due to unforeseen circumstances. This rider guarantees that the coverage and benefits will continue without any disruption, even during financial hardships caused by illness or injury.

- Income Benefit Rider: This rider provides a monthly income to the policyholder’s family in case of their untimely death. Instead of a lump sum payout, the beneficiary receives regular monthly payments, which can be beneficial for families looking for steady financial support.

- Total and Permanent Disability Rider: This rider ensures that if the policyholder becomes totally and permanently disabled, the insurance company will provide a lump sum amount or monthly income. The disability benefit helps policyholders to maintain their financial independence and protect their familys in case of a life-altering disability.

Most Common ULIP Myths Demystified

Myth 1 - ULIP are costly

ULIP had a heavy charge structure way back in 2008. However, IRDAI intervened and the cost of ULIP has reduced significantly over the years. If you are refraining from investing in ULIP due to the high cost, you don’t have to worry now.

Myth 2 – ULIP is a risky investment option

Under ULIP, investors are allowed to choose funds based on their risk appetite. ULIP come with several fund options such as debt and liquid funds for low-risk investors while equity funds for high and moderate risk investors.

Myth 3 – Lock-in period of 3 years

Earlier, the lock-in period was 3 years. But after 2010, IRDA revised the guidelines and extended the lock-in period from 3 years to 5 years. Now, ULIP have a lock-in period of 5 years.

Myth 4 – ULIP does not offer flexibility

ULIP plans offer complete flexibility to the investors. It provides the flexibility to switch between funds based on your risk appetite. It also gives you the flexibility to partially withdraw money from your accumulated Fund Value before the policy matures.

Myth 5 – Not a good option

ULIP is an ideal option for both your insurance and investment needs. It not only offers life cover but also provides investment options.

Myth 6 – ULIP provide low returns

ULIP plans offer maximum returns as compared to other investment options, if you choose wisely. It is one of the best investment options if you want to gain higher returns to fulfil your long-term goals.

Myth 7 - ULIPs are restrictive

This is not true. There are no restrictions on exiting the ULIP plan. You can discontinue from a ULIP anytime you want. If you decide to exit from the ULIP after the lock-in period, you can do so without paying any charges. However, surrender charges apply if you decide to exit before the lock-in period is over, you will be required to pay surrender charges.

Myth 8 - Health and accident cover is not provided in ULIP

This statement is also misleading. Apart from providing you with the dual benefit of both investment and insurance in a single plan, ULIP offers riders as well. You can receive additional protections such as Accidental death benefit, waiver of premium, etc. in the form of riders. ULIP also provides a partial withdrawal facility that can help you in times of emergency.

How to Calculate the Returns from Your ULIP?

The returns of ULIP plans are usually calculated in two ways which are listed below:

Absolute Returns: Absolute returns calculate the percentage increase in the ULIP value. It’s essentially the difference between the current value of your investment and its value when you initially bought it, adjusted for any expenses like management and administrative charges.

Absolute returns = [(Current value- Purchase time value)/ Purchase time value] x 100.

For example, if you purchased your ULIP for ₹450, and its value grew to ₹650 after one year, your absolute return would be:

Absolute Return (650−450/450)×100= 44.4%

This method works best for short-term investments where you're looking to see how much your investment has grown over a specific time frame.

CAGR (Compound Annual Growth Rate): CAGR provides a more accurate measure of long-term growth, as it shows the annualised return over a set number of years. Unlike absolute returns, which give you a snapshot of growth, CAGR smooths out the fluctuations and calculates the consistent growth rate your investment would have achieved annually to reach its current value.

CAGR = {[(Current value/Value at the time of purchase) ^ (1/number of years)]-1} x 100

For instance, if your ULIP was worth ₹250 when purchased and its value grew to ₹350 over five years, the CAGR would be:

CAGR= [(350/250)^1/5−1]×100≈ 6.96%

CAGR is particularly useful for evaluating investments over longer periods as it reflects the true annualised growth, helping you compare the performance of your ULIP to other investment options.

What are the Types of ULIP Plans Offered by Canara HSBC Life Insurance?

Canara HSBC Life Insurance offers ULIP plans designed to cater to different financial aspirations, risk appetites, and protection needs. Here’s how the three flagship plans are differentiated:

| Plan | Variants | Best for | Description |

|---|---|---|---|

| Promise4Growth Plus | Promise4Wealth Plus | Investment Objectives and Premium Flexibility | Balances wealth creation with life protection while supporting flexible premium payments to suit varying cash flows |

| Promise4Growth Plus | Promise4Life Plus | Fund Choices | Offers diverse fund options and fund-switching flexibility for changing market conditions |

| Promise4Growth Plus | Promise4Care Plus | Life Cover Choices | Provides enhanced life protection with optional critical illness cover alongside investments |

| SecureInvest | SecureInvest Forever | Investment Objectives and Life Cover Choices | Focused on long-term wealth accumulation with consistent returns while providing high life cover relative to fund value for family security |

| SecureInves | SecureInvest Choice | Fund Choices and Premium flexibility | Personalised fund selection with structured long-term options and systematic premium payments with loyalty benefits |

| Wealth Edge | Invest Plus | Investment Objectives and Premium Flexibility | Aggressive equity-focused wealth creation with flexible premiums and targeted fund allocation |

| Wealth Edge | Premium Plus | Fund Choices and Life Cover Choices | Provides flexible fund allocation with equity-debt mix and life cover options to match risk appetite and financial goals |

According to Investment Objectives:

Promise4Growth Plus (Promise4Wealth Plus): Best for investors looking to balance wealth creation with life protection, combining growth potential with a stable investment strategy.

SecureInvest (SecureInvest Forever): Ideal for those focused on long-term wealth accumulation, offering consistent growth and a disciplined investment structure.

Wealth Edge (Invest Plus): Suited for investors aiming for maximum wealth creation, with an equity-focused approach and higher growth potential.

According to Fund Choices:

Promise4Growth Plus (Promise4Life Plus): Offers diverse fund options and the ability to switch between funds, making it flexible for changing market conditions.

SecureInvest (SecureInvest Choice): Best for investors preferring structured fund choices with personalised fund selection for long-term goals.

Wealth Edge (Premium Plus): Provides maximum flexibility in fund allocation, including equity-debt balance, ideal for risk-adjusted growth.

According to Life Cover Choices:

Promise4Growth Plus (Promise4Care Plus): Perfect for those seeking enhanced life protection with added critical illness cover alongside investment benefits.

SecureInvest (SecureInvest Forever): Recommended for individuals wanting high life cover relative to fund value, prioritising family security.

Wealth Edge (Premium Plus): Offers flexible life cover options, allowing investors to choose cover levels based on personal risk appetite.

According to Premium Flexibility:

Promise4Growth Plus (Promise4Wealth Plus): Supports flexible premium payment terms, ideal for aligning investment with varying cash flows.

SecureInvest (SecureInvest Choice): Allows systematic premium payments with loyalty benefits, suitable for disciplined, long-term investors.

Wealth Edge (Invest Plus): Best for those seeking premium flexibility combined with targeted fund allocation, allowing adjustments as financial goals evolve.

Unit Linked Insurance Plan Frequently Asked Questions

In order to understand ULIP NAV, you first need to understand how ULIP work. In ULIP insurance plans, a portion of the premium from different investors is accumulated to create one investment corpus. This money is invested in several different market instruments. So to divide the returns properly among all the investors, the fund manager divides the net asset value into small units with a specific face value. NAV is the per-market share value of a fund. To better understand the definition of NAV, take a look at the formula below -

Net Asset Value = [Assets-(Liabilities + Expenses)] / Outstanding Units

The main difference between SIP, a systematic investment plan, and ULIP is that ULIP offers you insurance as well. In SIP, you are required to invest a certain sum of money at an interval chosen by you. This reduces the market risks and helps you grow your wealth over time.

ULIP, on the other hand, provides you with an option to invest your funds systematically and earn a return, and gives you life coverage as well. ULIP gives you a chance to invest in your own chosen fund. So, you not only get market-linked returns but also insurance cover.

Basis | ULIP | Traditional Plans |

Meaning | A financial product that gives you the benefits of both investment and insurance in a single plan | A type of plan that is characterised by guaranteed returns and low risk. |

Funds | You can choose to invest in both equity and debt. | The funds involved are mostly debt. |

Charges | Contains multiple charges, such as fund allocation, surrender charges | A few minimal charges are involved |

Transparency | Full transparency. All charges are known. The investor also has the option to track his funds. | Low transparency, no tracking allowed. |

Lock-in period | 5 years | No lock-in period |

Withdrawal | Can withdraw after the lock-in period is over | Once invested, you cannot withdraw before maturity |

Switching | Allows you to switch between funds | Not allowed. |

Here are the following major benefits of buying a ULIP

1. Tax Benefits- It helps you reduce tax liabilities. This means you are liable to enjoy tax benefits on the premiums paid towards the policy as per Section 80C of the Income Tax Act.

2. Long-term growth– One of the major benefits of buying a ULIP plan is that it offers long-term benefits. ULIP come with a lock-in period of 5 years, which will keep you invested for a longer period.

3. Dual benefits- ULIP not only offer life coverage but also come with a wide range of investment funds that will help you earn great returns. This includes balanced funds, debt funds, or equity funds. You can invest in any of them depending on your needs and risk appetite.

4. Flexibility- It gives you the flexibility to switch between funds based on your risk appetite. You could select multiple funds and different investment strategies.

5. Partial withdrawal option- It allows you to make a partial withdrawal in case of any uncalled medical emergency or contingency after completion of the lock-in period.

If you want to enjoy the triple benefits of life cover, good returns, and tax savings, then you must invest in ULIP. It's a great investment plan as compared to other investment options. In ULIP, the premium paid towards the policy is divided into two sections: Insurance and investment. Therefore, an individual investing in such a plan will not just fetch good returns but will get life protection cover as well.

ULIPs are life insurance products that provide paths to invest. And just like other investment options, there's no guaranteed investment return in a ULIP. If you like taking risks and want to earn more returns on your investment, then opt for equity funds.

Generally, the minimum lock-in period for ULIP is 5 consecutive policy years. During this time period, if the policyholder discontinues or surrenders the policy, then they will not be able to receive any payouts. Withdrawals are only allowed at the end of the lock-in period. In addition to this, if you surrender your policy before the lock-in period ends, then you will have to pay surrender charges as well. Also, it is advisable not to exit your plan after the completion of the 5-year lock-in period, because if you stay invested for a longer duration, it will help you reap better benefits.

ULIP is a perfect investment option if you are looking for long-term wealth creation. It could be buying your own house, a new car, going on a long vacation, or your child’s higher education or marriage. ULIP helps you to meet all your long-term financial goals. Moreover, it comes with a lock-in period of 5 years, which keeps you invested for a longer period and helps you earn better returns. The lock-in period is calculated from the date when the policy is issued.

The best time to invest was yesterday; the next best time is today. This statement fits aptly in the case of ULIP as well. The earlier you can invest in ULIP, the more time you will give your investment to grow. This will help you achieve your goals.

At the time of maturity of ULIP policy, you will get the fund value on your prevailing NAV. Fund value is the number of units of policy multiplied by NAV (net asset value).

Value of the fund = Total units of policy x NAV (Net Asset Value)

Well, discontinuing your premium payment will disrupt your savings as well as your financial goals. In such a case, you can approach your life insurance company and ask for the revival of a discontinued policy within the stipulated timelines. Also, you will have to pay all the unpaid premiums to revive the ULIP policy.

ULIP plan is a combination of investment and insurance. Thus, one must hold this plan for a duration of at least 10 years so as to get investment benefits out of it. An early exit will have its own consequences. ULIP have a lock-in period of 5 years. Thus, you may surrender your policy before the completion of 5 years, but you will be paid only after the end of 5 years.

It's not risky to invest in ULIP if you choose a safer path. Risk factor in ULIP depends on the investment option you choose. If you are not okay with sharp movements, then choosing a low-risk investment is a better idea. For people with high risk appetite, it's good to choose equity funds, while risk-averse investors can go for debt funds.

Yes, ULIP do offer tax benefits. In fact, it is one of the best tax-saving instruments. As per the Income Tax Act, 1961, you can save tax on your hard-earned money by investing in a unit-linked insurance plan. The premium paid towards ULIP is allowed a tax deduction of up to 1.5 lacs under section 80C of the Income Tax Act.

When can I withdraw ULIP?

You can withdraw free of any charge after the initial lock-in period. This lock-in period is generally 5 years. Some plans have a fixed number of withdrawals; after that, you are charged. While some plans give you unlimited free withdrawals as well.

If you want to withdraw before the lock-in period, you will have to incur the policy changes.

Yes, you can cancel/surrender your ULIP plan. This cancellation will incur expenses in the form of discontinuance charges if done before the lock-in period is over. Also, this ceases your life cover benefit as well. This is why discontinuing your policy is not advisable.

Knowing the multiple benefits ULIP offers, it is recommended to choose the best plan depending on your age and objectives. Canara HSBC offers different ULIP that are just perfect for you and will help you meet your financial goals.

We offer a range of ULIP plans for you to enjoy the benefits of investment and life insurance protection at the same time.

Related Articles of ULIP Insurance Plans

Popular Search

- What is ULIP?

- ULIP Tax Benefit

- ULIP Full Form

- ULIP Vs Term Insurance

- Best ULIP Plans

- Best ULIP Plan For Child

- Allocation Charges In ULIP

- ULIP Returns In 15 Years

- Difference Between ULIP and Mutual Fund

- ULIP Vs SIP

- Mortality Charges In ULIP

- What is NAV?

- How ULIP Works?

- Tips to Buy ULIPs

- ULIP Calculator

- Power of Compounding Calculator

- ULIP Tax Benefits in India