- Dismemberment Riders: They cover the loss or impairment of body parts or functions due to an accident

- Premium Waiver: It allows policyholders to stop paying premiums if they become disabled and unable to work

- Critical Illness Insurance: Provides a lump-sum payment for medical costs if the insured is diagnosed with a specified serious illness

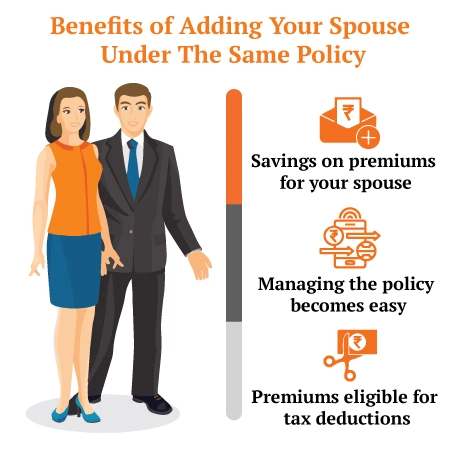

- Secondary Life Assured: This is typically the spouse whose coverage is often linked to the primary earner's policy terms

- Child Support Benefit: An in-built plan feature designed to provide financial payout to secure the children's future needs

Written by : Knowledge Centre Team

2026-02-17

1219 Views

5 minutes read

Share