- ITR-3 Form: Income Tax Return form used by individuals/HUFs earning business or professional income

- HUF: Hindu Undivided Family, a separate tax entity for Hindu families to pool income and claim tax benefits

- AY: Assessment Year is the year after a financial year when income is evaluated and taxes are filed

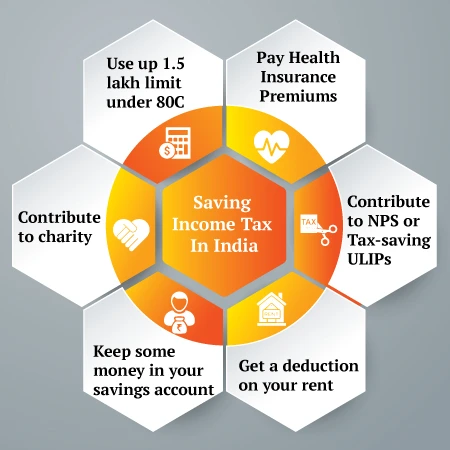

- Section 80C: Income Tax provision allowing deductions up to ₹1.5 lakh on eligible investments

- Audit: Mandatory review of financial records for certain businesses before filing the income tax return

Written by : Knowledge Centre Team

2026-01-11

1010 Views

6 minutes read

Share