- Goods and Services Tax (GST): A nationwide tax applied on goods and services, replacing multiple indirect taxes

- Input Tax Credit (ITC): A mechanism that allows businesses to use the GST paid on purchases to reduce the GST payable on their sales

- Unit Linked Insurance Plan (ULIP): A life insurance product that combines insurance coverage with market-linked investments.

- Term Insurance: A pure risk life insurance policy that provides coverage for a fixed term and pays benefits only on death.

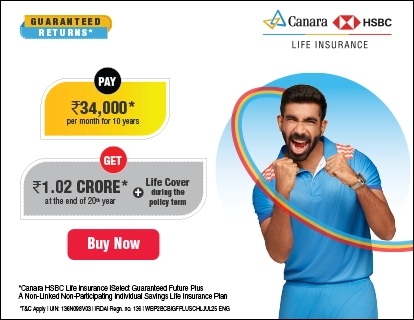

- Endowment Plan: A life insurance plan that offers both insurance cover and savings, paying out on maturity or death.

Written by : Knowledge Center Team

2025-12-17

2689 Views

7 minutes read

Share