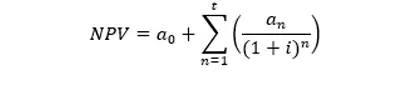

- NPV: A method to determine the value of future cash flows in today’s terms, factoring in returns, inflation, and opportunity cost.

- Opportunity Cost: The potential return lost when choosing one investment option over another, used as a benchmark in NPV calculations.

- Discount Rate: Interest rate that calculates the present value of future cash flows; mostly aligned with inflation or expected ROI.

- Payback Period: Time taken to recover the original investment from cash inflows; a quick risk-assessment tool for project evaluation.

- Internal Rate of Return: The rate at which an investment’s NPV becomes zero, helping compare investments with different durations.

Written by : Knowledge Centre Team

2025-12-26

3900 Views

10 minutes read

Share